- Home

- News & Media

- Detail

PT Tugu Reasuransi Indonesia (TuguRe) has commenced the transition to implement new reporting standards, namely International Financial Reporting Standard (IFRS) 17 and Application of Statements of Financial Accounting Standards (PSAK) 74. TuguRe's Finance Director, Drajat Irwansyah, stated that the company took the initiative to anticipate PSAK 74, which will be effective from January 2025.

In a written statement on Tuesday (4/4/2022), Drajat explained that being able to meet the new reporting standard nearly three years before its implementation would be a competitive advantage for any insurance company. TuguRe expects the transition process to proceed smoothly, allowing them to provide more optimal services to their partners.

IFRS 17 and PSAK 74 are aimed at enhancing transparency and comparability in financial reporting and are expected to bring about significant changes throughout the insurance industry. The key changes introduced by these standards involve treating insurance premium income as a liability rather than a direct gain. The resulting complexity and rigor in calculations and reporting will necessitate local insurance companies to revamp their accounting standards and processes.

Drajat emphasized that a seamless transition to PSAK 74 would enable TuguRe to better serve its customers. To facilitate this transition, TuguRe has decided to collaborate with SAS, a company specializing in analytics and artificial intelligence (AI). Drajat expressed confidence in SAS as the right partner for this transition, given their extensive experience in providing solutions to insurers worldwide.

SAS offers IFRS 17 solutions that support users in various tasks such as data management (ETL), cash flow calculations, contractual service margins (CSM), journal entries, and disclosure reporting. These solutions provide local insurers with a comprehensive and robust alternative for customized solutions, resulting in cost savings and reduced work hours. Furthermore, they ensure swift compliance with PSAK 74 well in advance of its effective date.

Febrianto Siboro, Managing Director of SAS Institute Indonesia, stated that many overseas insurance companies have already utilized SAS's IFRS 17 solution. He highlighted that SAS empowers insurance companies to protect their investments in actuarial, accounting, and related solutions by integrating the core capabilities of IFRS 17, ranging from data orchestration and analytics to risk and profitability reporting.

Febrianto added that SAS offers solutions that help organizations stay ahead of IFRS 17 requirements for compliance without compromising visibility. With cost-effective and customized solutions, organizations can avoid unnecessary expenses and delays in PSAK 74 compliance while significantly reducing the computational load associated with the new reporting guidelines.

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been honored with the Best Reinsurance Award at the Insurance Awa... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is proud to announce that its CEO has been awarded the Best CEO 2020 ... Read More

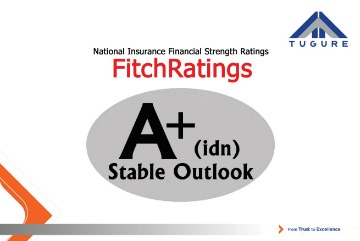

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its IFS rating of A+(idn) with a Stable O... Read More

To our esteemed Tugure Business Partners,

In commemorating the 34th Anniversary of PT Tugu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is delighted to announce that it has received an award in the Indones... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) remains optimistic in facing the insurance and reinsurance market in ... Read More

Link Berita > Read More

Tugure meraih penghargaan Gold Award (excellent) pada “Indonesia Finance Award-IV-2021 (IFA-IV-2021), category ... Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (TuguRe) menjalankan sejumlah strategi jitu sehingga mampu memp... Read More

Gelar Kelas Diskusi, Tugure Bahas statistik poperty dan engineering

Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (Tugure) menyelenggarakan webinar ... Read More

Dear Business Partner,

In connection with Eid al-Fitr 1 Syawal 1443 H, we hereby notify th... Read More

Fitch Ratings - Jakarta - 30 Nov 2022: Fitch Ratings Indonesia has affirmed PT Tugu Reasuransi Indonesia's (Tugur... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) posted positive performance throughout 2022 with growing premiu... Read More

Jakarta — Closing 2022, Tugure managed to record positive performance by maintaining Tugure's National Insu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) scored a brilliant performance throughout 2022 with a significant inc... Read More

The 2018 Insurance Award, which took place at the Le Meridien Hotel, is a prestigious event in the insurance world or... Read More

Jakarta - The national insurance industry is believed to still have the potential to grow supported by capital c... Read More

PT Tugu Reasuransi Indonesia (Tugure) held a Sharing Session event specifically discussing data center security amid ... Read More

Tangerang — PT Tugu Reasuransi Indonesia (Tugure) distributed Corporate Social Responsibility (CSR) assistance ... Read More

PT Tugu Reasuransi Indonesia (TuguRe) has commenced the transition to implement new reporting standards, namely Inter... Read More

Bali, October 17, 2019 – Tugure took the golden opportunity at the 25th Indonesia Rendezvous event, not only as... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) achieved impressive performance throughout 2022 with a significantly ... Read More

Jakarta (Men's Obsession) - When Erwin Basri was appointed as the Director of Operations, he immediately faced a ... Read More

Jakarta (Obsession News) - Erwin Basri's name is well-known in the insurance business world. His career journey i... Read More

BANYUWANGI - Several business classes of liability insurance are predicted to still have potential growth in 2023. Th... Read More

JAKARTA - The reinsurance industry, both globally and nationally, is expected to remain quite challenging in 2024. Read More

JAKARTA - The global and national reinsurance industry is expected to continue facing challenges in the form of a har... Read More

Bali – PT Tugu Reasuransi Indonesia (Tugure) has reaffirmed its support for the 27th Indonesia Rendezvous ... Read More

Bali - PT Tugu Reasuransi Indonesia (Tugure) is committed to integrating sustainable practices into all of its operat... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout 2023. These posi... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been awarded The Best Performing Reinsurance 2023 Based on Financ... Read More

Jakarta - Reinsurance company PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its national rating o... Read More

Hong Kong – In an effort to improve employee competencies in both soft and hard skills, PT Tugu Reasuransi Indo... Read More

Jakarta — The insurance business lines, both in energy and casualty globally, are still facing the trend o... Read More

Jakarta — The increase or inflation of medical costs in Indonesia is considered a challenge for health insuranc... Read More

Dear Business Partners,

In connection with the Eid al-Fitr 1 Shawwal 1445 H, we hereby inform you that our ... Read More

Jakarta – As part of PT Tugu Reasuransi Indonesia’s (Tugure) commitment to continuously transfer knowledg... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout the first half o... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) actively participated in the 2024 Indonesia Underwriting Summit... Read More

BALI – The 28th edition of Indonesia Rendezvous, initiated by the Indonesian General Insurance Association (AAU... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has once again demonstrated its remarkable achievements by rece... Read More

JAKARTA &n... Read More

Jakarta, May 7, 2025 Read More

Bangkok, Thailand (June 13, 2025) – PT Tugu Reasuransi Indonesia ... Read More

Jakarta, July 2, 2025 — PT Tugu Reasuransi Indonesia (Tugure) was honored with two prestigious... Read More

Jakarta, July 30... Read More

Jakarta, July 31th 2025 – PT Tugu Reasuransi Indonesia (Tugure) has once again ach... Read More

Seoul, August 19th, 2025 – PT Tugu Reasuransi Indonesia (Tugure), through Tugure A... Read More

Tokyo, July 25th 2025 – PT Tugu Reasuransi Indonesia (Tugure) reinforced its ... Read More

JAKARTA (August 27, 2025) — PT Tugu Reasuransi Indonesia (Tugure) has once again a... Read More