- Home

- News & Media

- Detail

Jakarta (Men's Obsession) - When Erwin Basri was appointed as the Director of Operations, he immediately faced a challenge: the world was hit by the Covid-19 pandemic, which had an impact on various sectors, including the insurance industry. In carrying out his role as an executive responsible for the operational activities of PT Tugu Reasuransi Indonesia (Tugure), Erwin Basri plays a crucial role in improving the operational efficiency of the company in any given situation. In an interview with the Men's Obsession team at his office one afternoon, Erwin took the time to share his experience.

"The pandemic was not included in the annual plan, so it was quite surprising and challenging for us. However, the company had to weather the storm. We organized our approach to achieve a balanced portfolio and increase technical reserves. We tackled each obstacle one by one. It was not easy, and it required the support of shareholders to discuss in detail the steps needed to ensure the company's sustainability for the next 10-20 years. Alhamdulillah, in the following year, we not only survived but also managed to increase our technical reserves," he explained.

Erwin acknowledged that the entire management team needed to have a shared goal, ensuring that each member understood their role. "We are all in the same boat. We have a common goal and we must work together to achieve it," he concluded.

Erwin Basri has been involved in the insurance industry for a long time. His career in this industry began when he joined Tugure in 1996 as a Claims Staff while studying. During that time, he gained valuable technical experience in reinsurance, which helped him develop his career in the industry. Due to his abilities, he was promoted to Assistant Manager and transferred to the Marketing Executive function. He was then selected to participate in the Internal Management Trainee Program, which provided training and development for talented employees.

Not only that, Erwin was entrusted with the position of Head of Non-Life Marketing Section with the rank of Assistant Manager, and two years later, he became the Non-Marine Group Head and eventually reached the position of Operational General Manager. In that role, he was responsible for ensuring the productivity, effectiveness, and efficiency of the Underwriting Non-Marine, Marine & Aviation, Life, Strategic Business Unit, Treaty, and Financial Risk work groups through planning, management, implementation, monitoring, and periodic evaluation.

The peak of his career journey came in 2020 when he was appointed as the Director of Operations. "This is a significant achievement for me because it has had a major impact not only on my personal development but also on the company where I have been working for 27 years," he said.

Speaking about his role, as an operational director in a reinsurance company, Erwin plays a crucial role in efficiently managing the company's operations. Alongside the management team, his tasks include formulating and implementing long-term business strategies for the reinsurance company by determining business priorities, identifying growth opportunities, and developing relevant action plans. He is also responsible for overseeing and controlling the operational aspects of the reinsurance company.

Another crucial role for the company is building and maintaining relationships with business partners and other stakeholders. By collaborating with all the underwriters at Tugure, he understands the needs of business partners and ensures their continuous satisfaction. Additionally, in the event of a crisis or emergency that could affect the company's operations, they anticipate by working with the risk management team to plan and implement risk mitigation strategies and business recovery.

Throughout 2022, Tugure achieved impressive performance with a significant increase in year-to-date profit. The positive results have boosted Tugure's optimism to drive sustainable business growth in 202

3. The year-on-year profit growth reached 277%, with a year-to-date profit of Rp26.86 billion in 2022. This achievement was supported by revenue growth, with a total revenue of Rp2.81 trillion throughout 2022. Tugure was able to increase premiums in line with the economic recovery after the Covid-19 pandemic.

On the other hand, the decrease in Tugure's gross claims value in the past year was a result of the company's policy to reduce exposure to certain fire insurance businesses. They minimized the potential claims from business lines with a high claims history. Furthermore, Tugure was able to maximize investment returns through a measured portfolio arrangement strategy in line with the improving economic conditions.

With the positive performance in 2022, Tugure is optimistic about driving sustainable business growth in 2023. Erwin believes that the insurance sector continues to be a pillar of the national economy, especially as people become more aware of the importance of insurance after the Covid-19 pandemic.

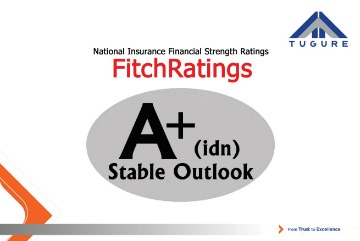

"The positive performance in 2022 demonstrates Tugure's efforts to maintain sustainability by enhancing the company's financial performance to provide the best service to business partners. This is supported by the stable financial capacity rating since 2017, which is A+ (idn) with a stable outlook, issued by Fitch Ratings Indonesia," he explained.

Erwin stated that achieving these goals requires collaboration and an open mind to receiving input and criticism from all parties. Additionally, the support of shareholders is crucial to instill confidence in the management team and employees to execute the planned work. "It is important that all employees understand that we are in the same boat, sailing together, so that we can all reap the benefits," he concluded.

As an industry operating on a global scale with different regulations, policies, and customer needs in each country, navigating the complexity of the insurance industry is a significant challenge. Erwin revealed that he must understand and comply with the regulations and requirements of each country where the company operates. He also ensures that the operations can adapt to policy changes and market demands in various regions. The insurance industry is rapidly evolving, especially in terms of technology, digitization, and business trends. The challenge lies in ensuring that the company's operations can effectively and efficiently adapt to these changes.

To achieve all of this, Erwin firmly adheres to several principles that he has applied throughout his career. Firstly, he believes that integrity builds trust and strong relationships with teams and customers. Secondly, inspirational leadership motivates teams to achieve their best performance.

As a father of three sons, he has a clear vision and goals for his career at Tugure, both personally and for the company. These visions and goals provide him with guidance and strong motivation to strive for success.

Erwin also expressed his hopes and obsession for Tugure. "Since I have grown with Tugure, my obsession is to bring Tugure to a regional and international level. Tugure is currently preparing itself to expand its portfolio even further. My hope is for Tugure to become the largest company in Indonesia with a healthy business continuity that meets the expectations of all stakeholders," he said optimistically.

Source: https://www.mensobsession.com/article/detail/1986/erwin-basri-direktur-operasional-pt-tugu-reasuransi-indonesia

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been honored with the Best Reinsurance Award at the Insurance Awa... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is proud to announce that its CEO has been awarded the Best CEO 2020 ... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its IFS rating of A+(idn) with a Stable O... Read More

To our esteemed Tugure Business Partners,

In commemorating the 34th Anniversary of PT Tugu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is delighted to announce that it has received an award in the Indones... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) remains optimistic in facing the insurance and reinsurance market in ... Read More

Link Berita > Read More

Tugure meraih penghargaan Gold Award (excellent) pada “Indonesia Finance Award-IV-2021 (IFA-IV-2021), category ... Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (TuguRe) menjalankan sejumlah strategi jitu sehingga mampu memp... Read More

Gelar Kelas Diskusi, Tugure Bahas statistik poperty dan engineering

Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (Tugure) menyelenggarakan webinar ... Read More

Dear Business Partner,

In connection with Eid al-Fitr 1 Syawal 1443 H, we hereby notify th... Read More

Fitch Ratings - Jakarta - 30 Nov 2022: Fitch Ratings Indonesia has affirmed PT Tugu Reasuransi Indonesia's (Tugur... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) posted positive performance throughout 2022 with growing premiu... Read More

Jakarta — Closing 2022, Tugure managed to record positive performance by maintaining Tugure's National Insu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) scored a brilliant performance throughout 2022 with a significant inc... Read More

The 2018 Insurance Award, which took place at the Le Meridien Hotel, is a prestigious event in the insurance world or... Read More

Jakarta - The national insurance industry is believed to still have the potential to grow supported by capital c... Read More

PT Tugu Reasuransi Indonesia (Tugure) held a Sharing Session event specifically discussing data center security amid ... Read More

Tangerang — PT Tugu Reasuransi Indonesia (Tugure) distributed Corporate Social Responsibility (CSR) assistance ... Read More

PT Tugu Reasuransi Indonesia (TuguRe) has commenced the transition to implement new reporting standards, namely Inter... Read More

Bali, October 17, 2019 – Tugure took the golden opportunity at the 25th Indonesia Rendezvous event, not only as... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) achieved impressive performance throughout 2022 with a significantly ... Read More

Jakarta (Men's Obsession) - When Erwin Basri was appointed as the Director of Operations, he immediately faced a ... Read More

Jakarta (Obsession News) - Erwin Basri's name is well-known in the insurance business world. His career journey i... Read More

BANYUWANGI - Several business classes of liability insurance are predicted to still have potential growth in 2023. Th... Read More

JAKARTA - The reinsurance industry, both globally and nationally, is expected to remain quite challenging in 2024. Read More

JAKARTA - The global and national reinsurance industry is expected to continue facing challenges in the form of a har... Read More

Bali – PT Tugu Reasuransi Indonesia (Tugure) has reaffirmed its support for the 27th Indonesia Rendezvous ... Read More

Bali - PT Tugu Reasuransi Indonesia (Tugure) is committed to integrating sustainable practices into all of its operat... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout 2023. These posi... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been awarded The Best Performing Reinsurance 2023 Based on Financ... Read More

Jakarta - Reinsurance company PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its national rating o... Read More

Hong Kong – In an effort to improve employee competencies in both soft and hard skills, PT Tugu Reasuransi Indo... Read More

Jakarta — The insurance business lines, both in energy and casualty globally, are still facing the trend o... Read More

Jakarta — The increase or inflation of medical costs in Indonesia is considered a challenge for health insuranc... Read More

Dear Business Partners,

In connection with the Eid al-Fitr 1 Shawwal 1445 H, we hereby inform you that our ... Read More

Jakarta – As part of PT Tugu Reasuransi Indonesia’s (Tugure) commitment to continuously transfer knowledg... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout the first half o... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) actively participated in the 2024 Indonesia Underwriting Summit... Read More

BALI – The 28th edition of Indonesia Rendezvous, initiated by the Indonesian General Insurance Association (AAU... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has once again demonstrated its remarkable achievements by rece... Read More

JAKARTA &n... Read More

Jakarta, May 7, 2025 Read More

Bangkok, Thailand (June 13, 2025) – PT Tugu Reasuransi Indonesia ... Read More

Jakarta, July 2, 2025 — PT Tugu Reasuransi Indonesia (Tugure) was honored with two prestigious... Read More

Jakarta, July 30... Read More

Jakarta, July 31th 2025 – PT Tugu Reasuransi Indonesia (Tugure) has once again ach... Read More

Seoul, August 19th, 2025 – PT Tugu Reasuransi Indonesia (Tugure), through Tugure A... Read More

Tokyo, July 25th 2025 – PT Tugu Reasuransi Indonesia (Tugure) reinforced its ... Read More

JAKARTA (August 27, 2025) — PT Tugu Reasuransi Indonesia (Tugure) has once again a... Read More