- Home

- News & Media

- Detail

Seoul, August 19th, 2025 – PT Tugu Reasuransi Indonesia (Tugure), through Tugure Academy, once again held an international Sharing Session—this time in Korea, following previous successful sessions in Thailand and Japan. The event, which involved 21 business partners, carried the theme “Charging The Future: Managing Risks in the EV Industry” as a manifestation of Tugure’s commitment to supporting the transformation of the insurance industry in line with advancements in technology and renewable energy.

In his opening remarks, Tugure’s Finance Director, Dradjat Irwansyah, expressed appreciation to business partners for their consistent support of the Sharing Session. He emphasized that this forum serves as a collaborative discussion platform, not only for the general insurance segment but also for life insurance.

Furthermore, Dradjat highlighted the establishment of the Operation Support Department (OSD) as Tugure’s strategic step to enhance services tailored to partner needs. OSD is a newly formed unit focused on improving the accuracy of premium and claims data. It functions to conduct periodic reconciliations, monitor SLA acceptance, and oversee claim aging to ensure faster and more transparent settlements.

“With OSD, reconciliations are conducted from the outset, making the claims process easier and more measurable, ensuring liquidity remains strong, and financial reporting under IFRS 17 becomes more accurate,” he explained.

In the main session, Tugure’s Property & Engineering Group Head, Aries Karyadi, presented various risks associated with the growth of the Electric Vehicle (EV) industry. He stressed that the global push through the Paris Agreement 2018 and the Indonesian government’s incentives for the EV industry bring major challenges, particularly concerning lithium batteries as the core component.

Aries outlined risks such as overcharging, overheating, thermal runaway, and battery fires that are difficult to extinguish with conventional methods.

“More than 50% of an EV’s value lies in its battery. A single damaged cell can be fatal. Therefore, these factors must be given special attention in both policy drafting and risk surveys,” he emphasized.

He also addressed risks in the EV logistics chain, including the need for third-party loss insurance during transportation, such as with RORO vessels. He underlined the importance of adjusting premiums according to risk levels and providing additional protection where needed.

“The insurance industry plays a crucial role in supporting the energy transition, including through risk education on green energy and the implementation of strict mitigation standards,” he added.

Closing the session, Tugure’s Technical Director, R. Djoko Slamet Prasetiyo, stressed the importance of close collaboration among industry players and regulators to achieve win-win solutions in managing EV risks.

“The EV phenomenon is both an opportunity and a challenge. Tugure is here to ensure that Indonesia’s insurance industry does not miss the momentum, learning from EV-producing countries such as Korea, and preparing the right mitigation strategies,” he concluded.

Through this Sharing Session, Tugure reaffirmed its role as a reinsurance company that not only provides protection capacity but also actively delivers insights, education, and innovative solutions for the insurance industry amid the ongoing transformation in energy and technology.

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been honored with the Best Reinsurance Award at the Insurance Awa... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is proud to announce that its CEO has been awarded the Best CEO 2020 ... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its IFS rating of A+(idn) with a Stable O... Read More

To our esteemed Tugure Business Partners,

In commemorating the 34th Anniversary of PT Tugu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) is delighted to announce that it has received an award in the Indones... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) remains optimistic in facing the insurance and reinsurance market in ... Read More

Link Berita > Read More

Tugure meraih penghargaan Gold Award (excellent) pada “Indonesia Finance Award-IV-2021 (IFA-IV-2021), category ... Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (TuguRe) menjalankan sejumlah strategi jitu sehingga mampu memp... Read More

Gelar Kelas Diskusi, Tugure Bahas statistik poperty dan engineering

Read More

Jakarta (ANTARA) – PT Tugu Reasuransi Indonesia (Tugure) menyelenggarakan webinar ... Read More

Dear Business Partner,

In connection with Eid al-Fitr 1 Syawal 1443 H, we hereby notify th... Read More

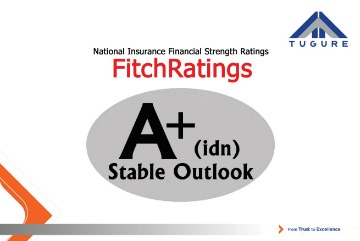

Fitch Ratings - Jakarta - 30 Nov 2022: Fitch Ratings Indonesia has affirmed PT Tugu Reasuransi Indonesia's (Tugur... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) posted positive performance throughout 2022 with growing premiu... Read More

Jakarta — Closing 2022, Tugure managed to record positive performance by maintaining Tugure's National Insu... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) scored a brilliant performance throughout 2022 with a significant inc... Read More

The 2018 Insurance Award, which took place at the Le Meridien Hotel, is a prestigious event in the insurance world or... Read More

Jakarta - The national insurance industry is believed to still have the potential to grow supported by capital c... Read More

PT Tugu Reasuransi Indonesia (Tugure) held a Sharing Session event specifically discussing data center security amid ... Read More

Tangerang — PT Tugu Reasuransi Indonesia (Tugure) distributed Corporate Social Responsibility (CSR) assistance ... Read More

PT Tugu Reasuransi Indonesia (TuguRe) has commenced the transition to implement new reporting standards, namely Inter... Read More

Bali, October 17, 2019 – Tugure took the golden opportunity at the 25th Indonesia Rendezvous event, not only as... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) achieved impressive performance throughout 2022 with a significantly ... Read More

Jakarta (Men's Obsession) - When Erwin Basri was appointed as the Director of Operations, he immediately faced a ... Read More

Jakarta (Obsession News) - Erwin Basri's name is well-known in the insurance business world. His career journey i... Read More

BANYUWANGI - Several business classes of liability insurance are predicted to still have potential growth in 2023. Th... Read More

JAKARTA - The reinsurance industry, both globally and nationally, is expected to remain quite challenging in 2024. Read More

JAKARTA - The global and national reinsurance industry is expected to continue facing challenges in the form of a har... Read More

Bali – PT Tugu Reasuransi Indonesia (Tugure) has reaffirmed its support for the 27th Indonesia Rendezvous ... Read More

Bali - PT Tugu Reasuransi Indonesia (Tugure) is committed to integrating sustainable practices into all of its operat... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout 2023. These posi... Read More

Jakarta - PT Tugu Reasuransi Indonesia (Tugure) has been awarded The Best Performing Reinsurance 2023 Based on Financ... Read More

Jakarta - Reinsurance company PT Tugu Reasuransi Indonesia (Tugure) has successfully maintained its national rating o... Read More

Hong Kong – In an effort to improve employee competencies in both soft and hard skills, PT Tugu Reasuransi Indo... Read More

Jakarta — The insurance business lines, both in energy and casualty globally, are still facing the trend o... Read More

Jakarta — The increase or inflation of medical costs in Indonesia is considered a challenge for health insuranc... Read More

Dear Business Partners,

In connection with the Eid al-Fitr 1 Shawwal 1445 H, we hereby inform you that our ... Read More

Jakarta – As part of PT Tugu Reasuransi Indonesia’s (Tugure) commitment to continuously transfer knowledg... Read More

Jakarta – PT Tugu Reasuransi Indonesia (Tugure) has achieved impressive performance throughout the first half o... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) actively participated in the 2024 Indonesia Underwriting Summit... Read More

BALI – The 28th edition of Indonesia Rendezvous, initiated by the Indonesian General Insurance Association (AAU... Read More

JAKARTA – PT Tugu Reasuransi Indonesia (Tugure) has once again demonstrated its remarkable achievements by rece... Read More

JAKARTA &n... Read More

Jakarta, May 7, 2025 Read More

Bangkok, Thailand (June 13, 2025) – PT Tugu Reasuransi Indonesia ... Read More

Jakarta, July 2, 2025 — PT Tugu Reasuransi Indonesia (Tugure) was honored with two prestigious... Read More

Jakarta, July 30... Read More

Jakarta, July 31th 2025 – PT Tugu Reasuransi Indonesia (Tugure) has once again ach... Read More

Seoul, August 19th, 2025 – PT Tugu Reasuransi Indonesia (Tugure), through Tugure A... Read More

Tokyo, July 25th 2025 – PT Tugu Reasuransi Indonesia (Tugure) reinforced its ... Read More

JAKARTA (August 27, 2025) — PT Tugu Reasuransi Indonesia (Tugure) has once again a... Read More